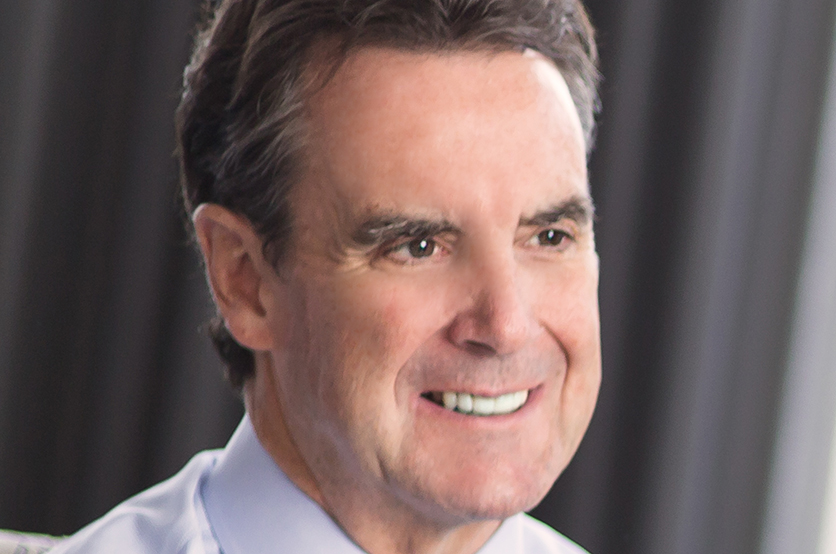

ST. LOUIS, MO – OCTOBER 9, 2020 – The Fortune Group, a leading mergers and acquisitions advisory boutique, is pleased to announce the promotion of Bradley Scharfenberg to Senior Associate. Brad joined The Fortune Group as an Analyst in 2012 and has been an integral member of the firm’s M&A advisory team since that time....

Read More